Contents

Some forex brokers require a minimum initial deposit of only $50 to open an account, while others allow you to open accounts with no initial deposit. The futures market offers uniform quantities of currency exposure ranging from small to large that entail either delivery or settlement back to cash in your account upon expiration. Institutions and everyday people alike can hedge risk or speculate on the future path of currency prices using futures contracts.

Is the research you’ve conducted indicating the base currency (the first-named currency in the pair) is likely to weaken or strengthen? Go long and ‘buy’ if you believe it will strengthen, or go short and ‘sell’ if you think it will weaken. Once you have a trading strategy that you have developed, you’ve no idea whether it works or not. Learn about technical analysis where you have tools like chart patterns, candlestick patterns, support & resistance, and trendlines. Study others’ systems, study everything that you can get your hands on.

Exotic currency pairs are usually made up of one major currency and one currency of an emerging economy, such as Hong Kong, Singapore, or Mexico. If you decide to buy a currency pair, you are buying the base currency and will be selling the quoted currency. Meanwhile, when you sell the currency pair, you will be selling the base currency and will be receiving the quote currency. There are also various trading styles that depend on the time frame and holding period of every trade.

The foreign exchange market

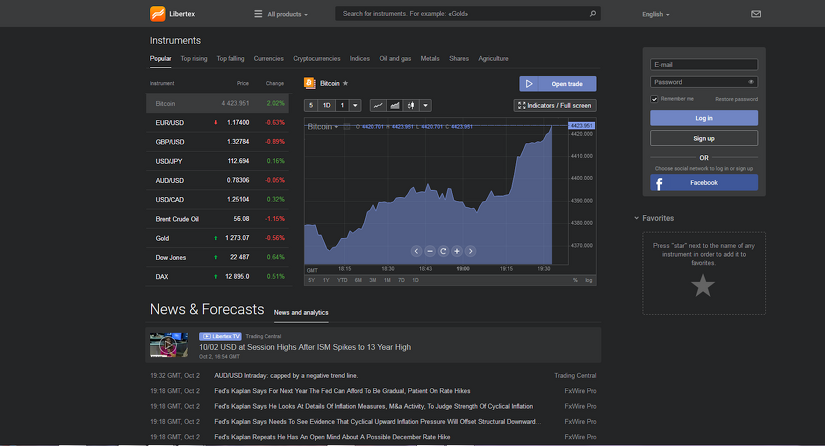

A shaken market is a good thing for traders, as this means more volatility to take advantage of. Traders can go long or short these assets without having to own currencies or any other underlying asset. Using CFDs, traders can speculate on the direction of the price of each asset, and trade derivatives contracts that settle for the difference in the exchange rate.

A graph that breaks down the movements of a particular currency that have occurred within a single trading day. You will want to limit your risk on each trade to $1 (1% of $100). It helps to see how different trading amounts can influence your minimum amount for day trading. The previous examples of $100, $500, and $5,000 are excellent for seeing the differences and working through the calculations to find your limit. Loss or gain from pip movement is calculated by multiplying the pip value by how many pips a currency moves by. The 1% rule is one of the best methods for mitigating trade risk.

If you aren’t risk adverse or careful, it can be easy to get ahead of yourself and lose quite a bit of money. We’ve determined that the forex market seems like a pretty sweet gig, right? Currency values that are always changing, light regulations, and leverage seem pretty cool. They know what they are doing and because of their low prices and solid track-record, they make our list.

The most basic forms of forex trades are a long trade and a short trade. In a long trade, the trader is betting that the currency price will increase in the future and they can profit from it. A short trade consists of a bet that the currency pair’s price will decrease in the future. Traders can also use trading strategies based on technical analysis, such as breakout and moving average, to fine-tune their approach to trading. It’s easy to start day trading currencies, because the foreign exchange market is one of the most accessible financial markets.

What can I do to prevent this in the future?

This narrow focus makes paying attention to all that is required a lot easier. However, the Ichimoku cloud has flipped red and the Tenken-sen and Kijun-sen have crossed bearishly. These are bearish signals that indicate a short trade is likely to be successful. Note that support comes down to a very specific decimal point and range. If the support level fails, there are two potential support levels below.

Stay informed with real-time market insights, actionable trade ideas and professional guidance. Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy. Factor incoming data and news into the major fundamental themes of interest-rate expectations, economic-growth prospects, inflation, cycle analytics for traders and structural developments. By checking this box, you agree to the Terms of Use and Privacy Policy & to receive electronic communications from Dummies.com, which may include marketing promotions, news and updates. The buy price of a currency is called the “bid” while the sell price of the currency is referred to as the “ask”.

Forecast the Weather Conditions of the Market

One of the key aspects of Forex trading is the ability to trade using “leverage”. It determines the required margin and amount of funds traders need to have in their trading accounts in order to take a position. Put simply for beginners, leverage allows you to take a position of much higher value than the monies deposited in your trading account. So in other terms, a higher leverage means a lower margin requirement to place a trade. This is where forex traders enter into binding contracts with each other, locking into a particular exchange rate for an agreed amount of currency at a future date. A “buy low, sell high” type of trading strategy, swing or momentum trading involves getting into and out of the market usually based on signals from momentum technical indicators like the RSI.

Foreign exchange marketsprovide a way tohedge currency risk by fixing a rate at which the transaction will be completed. In the United States, the National Futures Association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterparty to the trader, providing clearance and settlement services.

Make a Living Trading Forex

There are some things that everyone should know before entering this vast market. Trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their interconnectedness to grasp the fundamentals that drive currency values.

Why is trading so difficult?

Trading is so hard because there are so many aspects to trading that you need to know. Some of those are the quantity of misleading information out there, your own biases, and the necessity of striking a balance between risk and return.

“Margin” refers to the account balance required in order to maintain an open position. This term refers to when a trade is put in motion and subsequently completed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a standard lot of 100,000, then each pip move is $10. Rather than dozens of different categories of companies to consider, there are only currencies.

For example, you’ll need to know in advance the dates when countries make public their key economic announcements concerning GDP figures, balance of payments, inflation rates and so on. For example, a multinational headquartered in one location might use the forex market to hedge currency risk resulting from transactions carried out by subsidiaries around the world. Forex is also used to speculate on the impact of geo-political events such as the increase in tensions between Russia and the West over Ukraine.

If the price moves above the 100-day high, that’s a much stronger signal than if the price of a particular asset were to break above the 20-day high. “Rally” references a currency’s recovery in price after a period of either short-term or long-term decline. Within any currency pair, the second currency listed will always be referred to as the “quote currency”. For example, in the USD/GBP pairing, the GBP is the quote currency. If an investor has a set price in mind for a forex transaction, he or she can choose to implement a fill or kill order.

Summary: Why Trade Forex Currencies?

As this system progressed, merchants would travel between different regions on ships in order to trade goods like spices and salt for other items, creating the first foreign exchange. There are exotic pairs, which involve a major currency combined with a minor currency, such as EUR/CZK, USD/PLN, and GBP/MXN. The minor pairs, which consist of other major currencies, include GBP/JPY, EUR/GBP, and EUR/CHF. Market participants can trade in the spot market and also buy and sell derivatives.

The most common chart types are bar charts and candlestick charts. Although these two chart types look quite different, they are very similar in the information they provide. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs. I understand that I may not be eligible to apply for an account with this FOREX.com offering, but I would like to continue.

The truth is currency trading is an art you can master with the correct tools, support and experience. Give yourself time to learn the market and trends and you will be a pro in due time. The desire to research and keep up with global economies helps too. If you take the time to read helpful guides on forex trading to learn the basics, you’ll get a real leg up. Currency pairs trade in a set number of quantities, known as lots.

A spot exchange rate is the rate for a foreign exchange transaction for immediate delivery. Even though they are the most liquid markets in the world, forex trades are much more volatile than regular markets. The forex market is more decentralized than traditional stock or bond markets. There is no centralized exchange that dominates currency trade operations, and the potential for manipulation—through insider information about a company or stock—is lower. Forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity.

Understanding Currency Pairs

Forex trading can be a lucrative way to capitalize on changing currency values around the world, generating profit from these price movements. Forex pairs trade in units of 1,000 , 10,000 , or 100,000 lots. When USD is listed second in the pair—such as EUR/USD—and you fund your account with U.S. dollars , the value of the pip per type of lot is fixed in USD.

Foreign exchange futures markets let you trade specific exchange rates like EUR/USD or broad markets like USD versus multiple other currencies in a low-cost, straightforward structure. Now that you have a live trading account at a reputable online broker, you should plan on developing a trading strategy to boost your chances of success in the market. One or more strategies could suit your personality and level of market expertise, and the general strategy types discussed below are in common use among retail forex traders. All of the existing major currency pairs have the U.S. dollar on one side, either as the base currency or the quote currency.

This is why my suggestion, when it comes to forex for beginners, first and foremost, is to absorb as much as you can about this trading environment that you’ll be in. Understand what’s Forex, how it works, read books on it, and study books on it. Follow this framework and I believe you’ll find greater success in the markets instead of just diving head straight and then finding yourself losing money day after day, week after week.

Can you access the customer service firm by phone, email, and chat? The quality of support can vary drastically from firm to firm, so be sure to experience it firsthand before opening an account. You can easily conduct the trades in major financial centers of London, New York, Zurich, Paris, Tokyo, Singapore, Sydney, and Hong Kong – across tma+cg mladen almost every time zone. Investors are presented with numerous opportunities once they enter the forex markets. But like with everything else, you still have to familiarize yourself with the basics behind currency movements in order for you to be successful in the field. Learn how to trade forex in a fun and easy-to-understand format.

Much like other instances in which they are used, bar charts are used to represent specific time periods for trading. Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price for a trade. A dash on the left is the day’s opening price, and a similar dash on the right represents the closing price.

This means that the broker can provide you with capital in a predetermined ratio. For example, they may put up $100 for every $1 that you put up for trading, meaning that you avatrade copy trading review will only need to use $10 from your own funds to trade currencies worth $1,000. You can trade forex via a spread betting or CFD trading account via desktop or mobile devices.